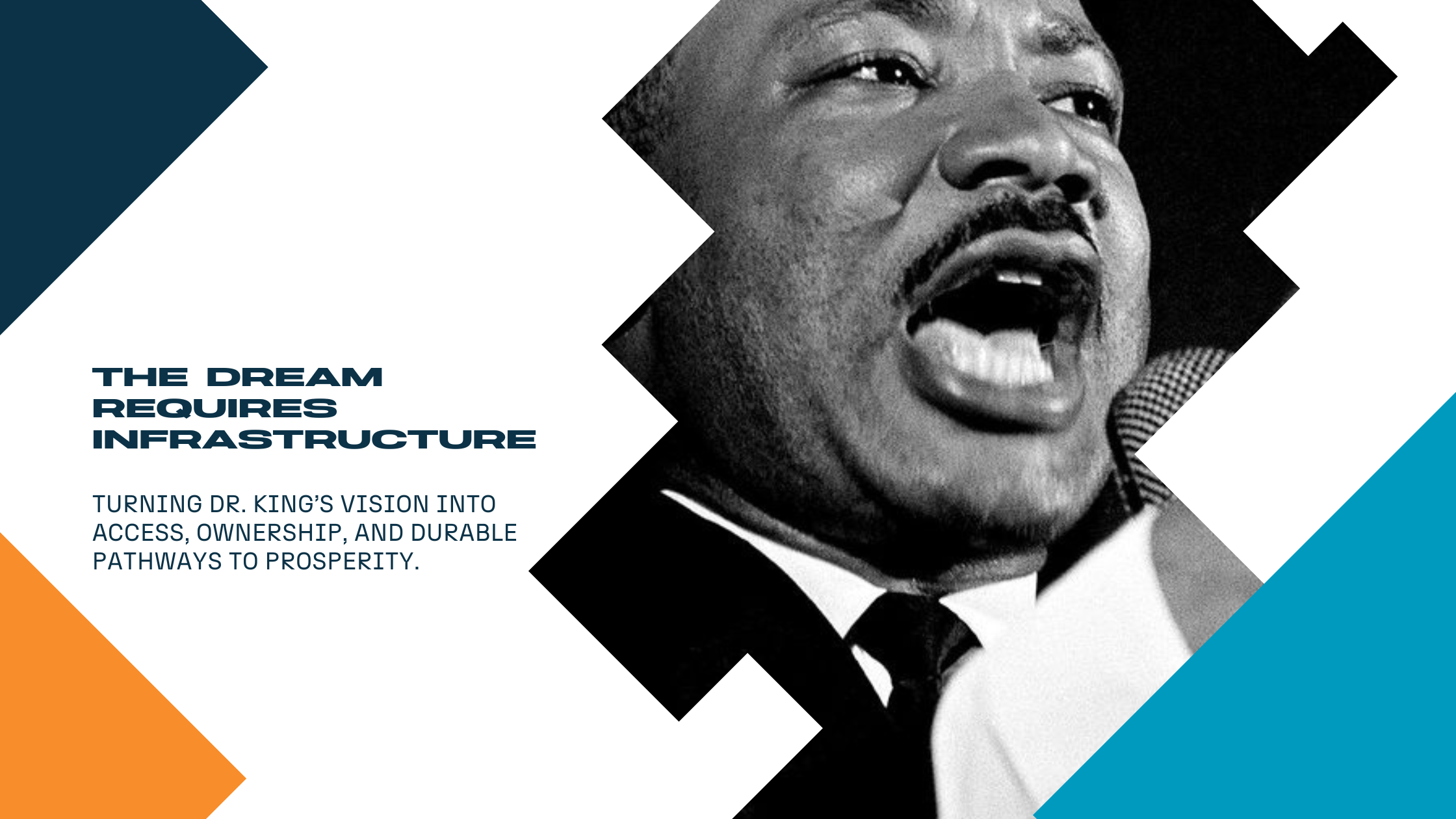

THE DREAM REQUIRES INFRASTRUCTURE

Turning Dr. King’s vision into access, ownership, and durable pathways to prosperity.

Picture a fall evening on Charleston, West Virginia’s West Side: storefront lights humming, neighbors lingering on stoops, Black-owned businesses alive with talk and music—an island of community and possibility in a segregated city.

That was The Block—a district shaped by my great-grandfather, A.H. Brown, a son of freed slaves with a fourth-grade education who became a real estate magnate.

He didn’t just buy property. He built an ecosystem.

Quality housing when Black families were boxed out.

Commercial spaces when Black entrepreneurs were denied a foothold.

A neighborhood anchor that helped community life endure for decades.

When I think about Martin Luther King Jr. Day, I think about that kind of leadership: not the kind that simply argues for access, but the kind that creates it.

Because dreams don’t survive on inspiration alone. They survive when someone lays down brick, policy, and capital—something tangible enough to carry a family forward.

And right now, we’re living in another moment that demands builders.

For generations, we’ve been taught that hard work and a steady paycheck are the pathway to stability. But wages alone don’t build wealth—assets do. And when people are locked out of asset ownership—especially homeownership—it doesn’t just hurt individual families. It weakens neighborhoods, limits mobility, and keeps entire communities from reaching their potential.

At the center of the problem is something we don’t talk about enough: access. Access to affordable capital. Access to fair credit. Access to guidance you can trust. Access to tools built for the realities people actually live.

Too many capable people are still treated as “high risk” not because they are irresponsible—but because the system doesn’t recognize their full story, their real constraints, or their real potential.

That’s why we created On Our Block®.

On Our Block is built on a simple belief: personalized, tech-enabled banking can uplift communities at scale—when it’s rooted in trust, delivered through local partners, and designed to move people toward ownership.

This approach isn’t charity. It’s a model steeped in the idea of value creation:

Residents gain stability and a clear path to ownership

Banks gain loyal customers and durable growth

Cities gain stronger neighborhoods and long-term economic health

We’ve already seen what’s possible when you connect financial tools to real community outcomes—helping families move from “maybe someday” to “we got the keys.”

That’s the point.

Homeownership remains one of the most reliable engines for building generational wealth in America. It’s how parents pass something down. It’s how neighborhoods stabilize. It’s how families build a foundation that outlasts any single paycheck.

In many ways, this work is a continuation of what A.H. Brown understood in his time:

When people can’t access what they need through existing systems, we must build new systems that restore agency.

MLK Day is a reminder that progress isn’t inevitable. It’s constructed by people who decide to turn values into infrastructure.

So today, I’m reflecting on two truths at once:

We honor Dr. King by remembering the dream.

We honor our ancestors by building what the dream requires—access, ownership, and durable pathways to prosperity.

If you’re a community leader, financial institution, public-sector partner, or builder who believes this work matters, I’d love to connect.

Because closing the wealth gap doesn’t start on a podium.

It starts on our blocks—where people live.

#MLKDay #EconomicMobility #Homeownership #FinancialInclusion #CommunityWealth #OnOurBlock